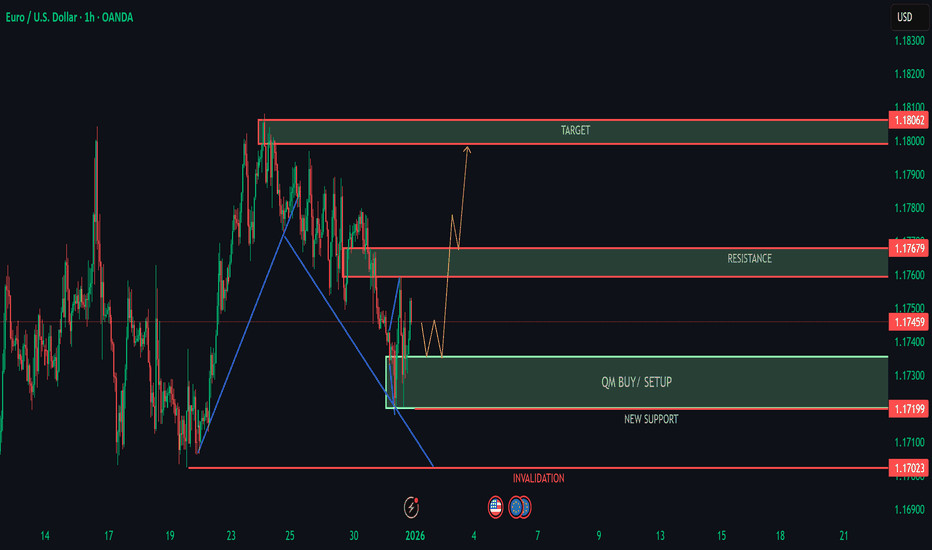

EURUSD Pullback Into New Support | Continuation Scenario

EURUSD has completed a structural breakout, flipping prior resistance into new support. Price is now pulling back into a clearly defined demand zone, where buyers previously stepped in aggressively.

The blue trendline shows the broader bullish structure remains intact, while current price action suggests consolidation before the next move. As long as price holds above the green support area, the bias favors continuation toward the higher resistance and target zone.

Failure to hold this support would invalidate the setup and signal deeper retracement, making this area a key decision point for the market.

Compression after expansion often leads to another impulse patience and confirmation are key.

Educational idea only. Not financial advice